To understand what flood insurance covers, you need to know three things first:

1. Standard homeowners insurance doesn’t cover flood damage at all. It’ll cover some damage from rain, but if your home is filled with water as a result of rising bodies of lakes, rivers, streams, and oceans, it won’t cover you.

2. The most common flood insurance is offered through the federally regulated program known as the National Flood Insurance Program (NFIP). It has two policies:

- One that covers your actual home (building property) up to $250,000

- One that covers your personal property up to $100,000

You can buy one or both.

Related: What happens if you need more than $250,000 worth of coverage? You need to get excess flood insurance, which is only offered by private companies, not the Feds.

3. You might have to buy it. If you’re taking out a mortgage on a property that’s in a high-risk zone (also called a Special Hazard Flood Area), your lender will require you to buy a policy in order to get the loan. If you just want to buy policy, you have to make sure your community participates in the national flood program. Flooding affects every state, so you’re probably eligible.

Related: Should You Buy Flood Insurance?

What the Federal Flood Insurance Program Covers

NFIP’s building property policy covers the cost to rebuild or the actual value of your home (whichever is less). That includes:

- Your home and its foundation

- Electrical and plumbing systems

- HVAC equipment like air conditioning, furnaces, and water heaters

- Kitchen appliances, including your refrigerator, stove, and built-ins such as your dishwasher

- Permanently installed carpeting over an unfinished floor

- Permanently installed wallboard, paneling, bookcases, and cabinets

- Window blinds

- Detached garages (limited to 10% of your home policy)

- Debris removal

- Water heater

The NFIP policy that covers your personal property will cover stuff like:

- Clothing, furniture, and electronic equipment

- Curtains

- Window AC units

- Portable microwaves and dishwashers

- Carpets not covered by your building policy

- Washer/dryers

- Your freezer and frozen food

- Up to $2,500 in valuables, such as art and furs

Note: Personal possessions claims are paid based on actual cash value — not what you paid for them.

What Isn’t Covered

Typically, if it belongs in a bank or safe deposit box, it’s not covered:

- Precious metals

- Stock certificates

- Bearer bonds

- Cash

Other items not covered:

- Trees

- Plants

- Wells

- Septic systems

- Walkways

- Decks

- Patios

- Fences

- Hot tubs

- Swimming pools

- Boat houses

- Retaining walls

- Storm shelters

- Temporary housing and other living expenses

- Loss of income

- Cars

- Post-flood mold damage (more about insurance and mold here)

- Sewer backups

Coverage is Limited for Basements

If you have a basement, you’ll have more risk because the NFIP limits coverage for basements, crawlspaces, or any living space where the floor is below ground level. Even a walkout basement won’t be covered for:

- Bookcases

- Window treatments

- Carpeting, tile, and other floor coverings

- Some drywall, depending on how far below ground level it is

- Paneling

- Walls and ceilings not made of drywall

- Most personal property such as clothing, electronic equipment, kitchen supplies, and furniture

There’s a Limit to How Often You Can Collect

If you make four or more flood claims for more than $5,000 each, or two claims that, added together, cost more than your home, NFIP will “offer” you a grant to make your home less vulnerable to floods. If you refuse to take the grant money and make the improvements, your policy payments will probably increase substantially.

If a Flood Severely Damages Your Home

NFIP may give you $30,000 to use to raise, tear down, or move your home. That $30,000 gets added on to any other claim NFIP pays you. But the total still can’t go above $250,000.

How Much Does It Cost?

The average cost is about $600 for a one-year premium; your insurance company, which issues the policy, can give you a quote. Ultimately, the amount depends on such factors as the amount of coverage, deductible, the risk level of your flood zone, and the age of the building.

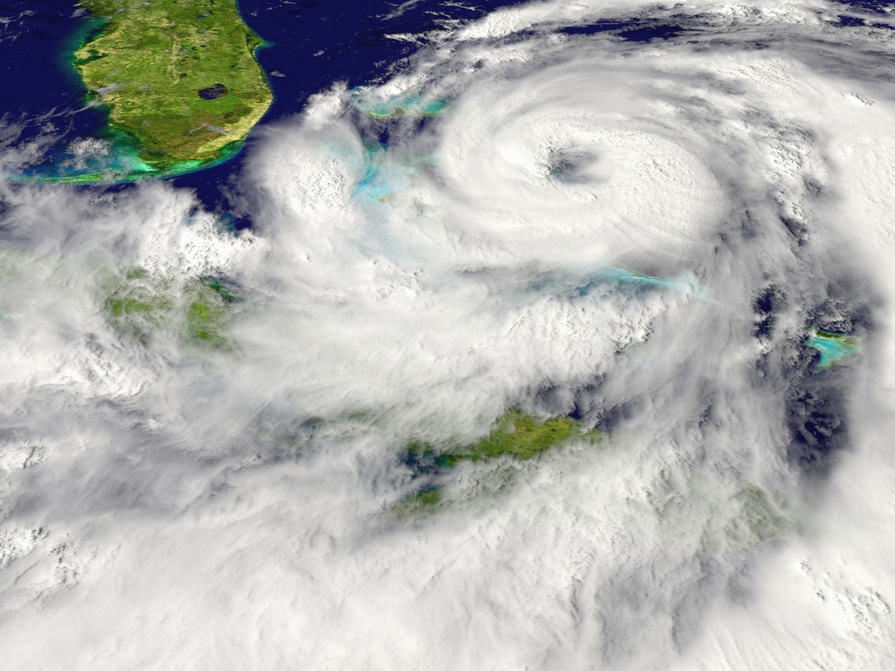

More About What Qualifies as a Flood

As mentioned earlier, regular homeowners insurance doesn’t cover floods. So when is damage considered to be caused by a flood?

- Water has to cover at least 2 acres of land that’s normally dry, or has to have damaged two or more properties (one being your home).

Also, the water has to come from:

- Overflowing inland or tidal waters

- Unusual, rapid accumulation or runoff of surface waters from any source

- Mudflow (that’s mud carried by a flow of water, creating a river of mud)

You’re also covered when shorefront land collapses or sinks due to waters above “anticipated cyclical levels.”

Water and seepage that comes from sewer or drain backups, or a sump pump that overflows is not considered a flood.

TIPS:

- Don’t wait for an impending storm to purchase federal flood insurance. There’s usually a 30-day waiting period. Some private policies offer a 15-day waiting period.

- Make an inventory of the possessions in your home to make filing a claim easier.