The region in which you live dictates what kind of disaster insurance you might need to protect your home from Mother Nature’s wrath.

Real estate comes down to location, location, location. Same goes for disasters. Where you live offers clues to how susceptible your home is to damage by floods, tornadoes, hurricanes, earthquakes, wildfires, and other calamities.

These regional risks also indicate whether you need to consider purchasing supplemental disaster insurance to cover claims that wouldn’t be included under a typical homeowners policy. Determining if you live in a disaster-prone region and reviewing your existing coverage are good first steps.

The next step is to create a home inventory, ideally with a digital camera or camcorder. Store copies of those files far away from your house or online at a backup storage site. That way, even if your home and computer are damaged, you’ll have proof of what was lost. Remember, too, to devise a family evacuation plan and assemble an emergency kit with food, water, and supplies.

Floods

Homes in low-lying areas, near bodies of water, or downstream from dams are particularly vulnerable. Saturated carpet, insulation, and drywall can promote mold growth. Since flood damage is often excluded from homeowners policies, it’s important to weigh the risk to your property.

At-risk regions: All

Coverage: Find out if your homeowners policy differentiates between “falling water” flooding — heavy rain, which may be covered — and “ground water” flooding, which usually isn’t. Most insurers sell flood insurance, but it may be more difficult to get in high-risk regions. The National Flood Insurance Program is open to anyone. Most experts recommend insuring your home and its contents at the replacement value.

Cost: The average flood insurance policy costs $600 per year, while the average flood claim is $30,000, according to the NFIP.

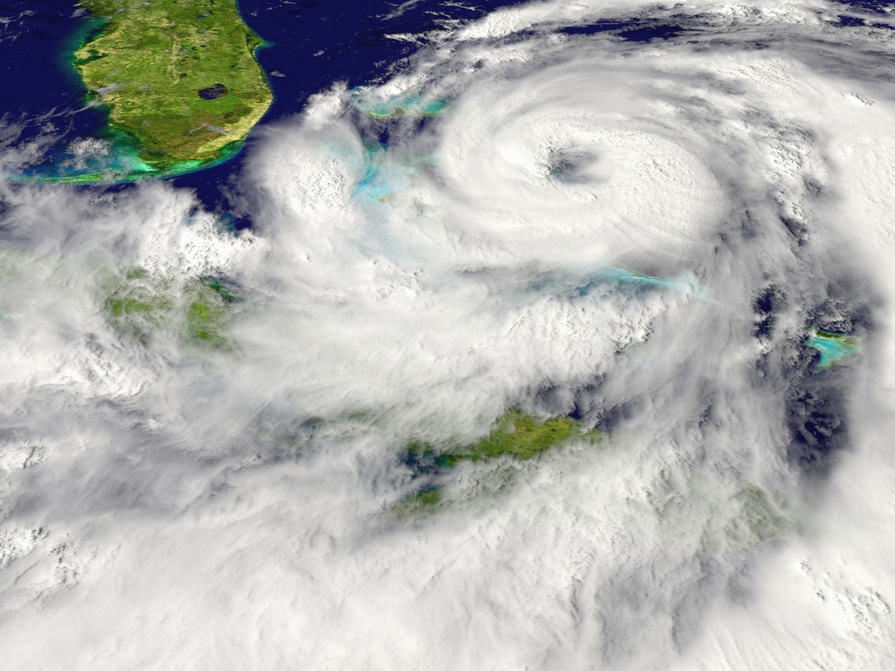

Hurricanes

Damage from hurricanes can result from heavy winds, rain, hail, and tidal or groundwater surge. Insurers in areas that have been battered by storms — especially coastal regions in the Southeast — are more skittish than those in other areas.

At-risk regions: Primarily East Coast and Gulf Coast

Coverage: In low-risk areas, your homeowners policy may cover any damage not done by rising water or groundwater surge. In high-risk areas, you may need to purchase additional coverage or participate in a state-run pool for hurricane and windstorm coverage. Your state’s insurance commissioner can provide details. Be sure to check whether additional hurricane coverage includes flooding from tidal or groundwater surge, or if you need a separate flood policy.

Cost: David Miller, CEO of Brightway Insurance in Jacksonville, Fla., says he has seen comprehensive windstorm and flood policies range from $300 for low-risk areas to up to $20,000 for high-end homes in the riskiest communities.

Earthquakes

Although earthquakes are associated with California, fault lines run through virtually every region. The U.S. Geological Survey tracks the latest quakes and keeps maps that show existing fault lines. Even minor earthquakes can damage belongings and leave houses structurally unsound.

At-risk regions: West Coast, especially California, and parts of Midwest

Coverage: Homeowners policies typically exclude earthquake damage. In California, supplemental coverage is available through the California Earthquake Authority. In other states, it’s usually available from private carriers. Your state’s insurance commissioner will have information on options.

Cost: A typical earthquake policy runs between $1.50 and $3 per $1,000 of coverage per year, with a deductible of 5% to 15% of the home’s value. If a home is insured for $200,000, the deductible would be $10,000 to $30,000, possibly with separate deductibles for the structure and the contents.

Tornadoes

Winds can reach up to 300 miles per hour and spiral into violent funnels. Although there’s not much that can be done to guard against tornadoes, keeping a home’s exterior in good repair can help mitigate damage from high winds.

At-risk regions: Eastern U.S, especially Central Plains

Coverage: Tornadoes are typically covered under your homeowners insurance. However, it’s a good idea to read over your policy or call your agent for confirmation.

Cost: Homeowners insurance premiums in recent years have averaged about $800 annually.

Wildfires

Approximately 68,000 wildfires burned more than 9.3 million acres in 2012. Every state but Hawaii was hit. Areas that are experiencing drought are most at risk. Damage to homes can result from flames themselves, but also from smoke, soot, and even the water used to fight the fires.

At-risk regions: All

Coverage: Fire is typically covered by a standard homeowners policy. Be sure to verify exactly what your coverage entails. Is cleanup included? How about full replacement value?

Cost: In recent years homeowners policies have averaged as low as $477 (Idaho) to as high as $1,409 (Texas).

Mine subsidence

Homes built over or near abandoned mines are at risk of structural damage if the ground shifts or sinkholes develop. Mine subsidence can also affect the water supply and utilities in the area.

At-risk regions: Primarily Eastern U.S.

Coverage: Mine subsidence isn’t typically covered by homeowners insurance. Coverage is usually available through state-sponsored pools, so check with your state’s insurance commissioner.

Cost: Premiums vary. In Pennsylvania, $130,000 in residential coverage is about $7 per month. In Illinois, it costs less than $95 per year to insure a house worth up to $250,000.