Why Fixing Up Your House Can Help It Sell Faster

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new appliances.”

It makes sense when you think about it. They’re having to pay a lot of money for a house in today’s market. That means they may not be able to easily afford upgrades after they move in. So, if your home is outdated or needs some work, buyers might pass it by or offer a lower price than you were hoping for.

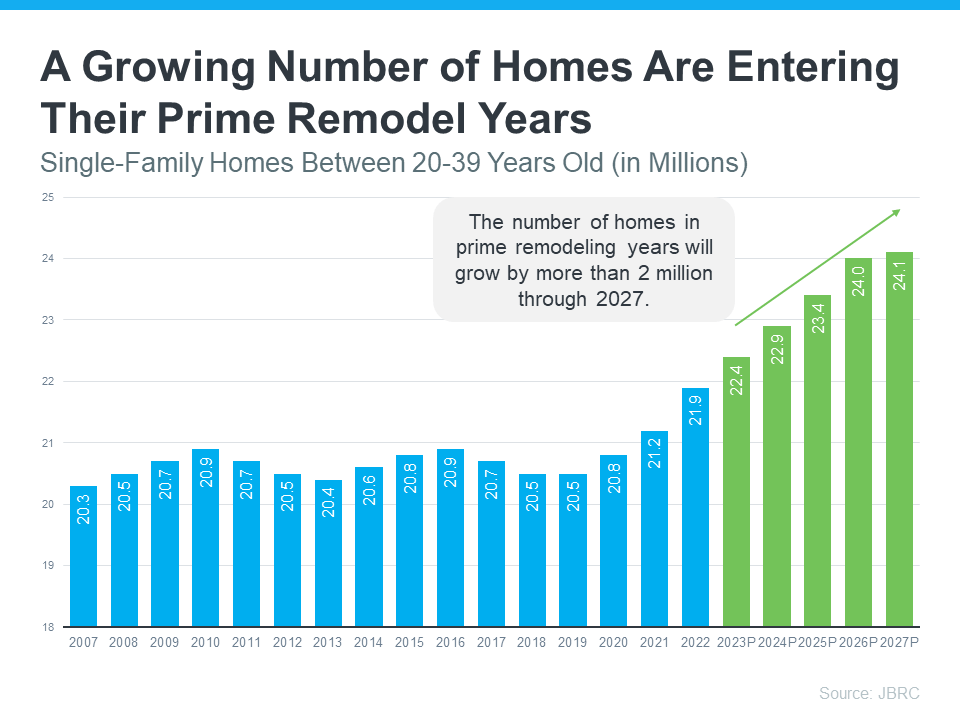

And there are a lot of homes that need upgrades right now. Millions are entering their prime remodel years, meaning they’re between 20 and 39 years old. Maybe yours is one of them. According to John Burns Research and Consulting (JBRC), the number of homes in their prime remodel years is high and growing (see graph below):

If your house falls into this category, it’s important to consider making selective updates to help it appeal to buyers, so it sells faster. But how do you know where to spend your time and money?

Why You Need a Real Estate Agent

By working with a local real estate agent to be strategic about the improvements you make, you can be sure you’re making a smart investment. Put simply, not all upgrades are worth the cost. As Bankrate says:

“Before you spend money on costly upgrades, be sure the changes you make will have a high return on investment. It doesn’t make sense to install new granite countertops, for example, if you only stand to break even on them, or even lose money.”

And, as that same Bankrate article goes on to say, that’s where a local real estate agent comes in:

“. . . a good real estate agent will know what local buyers expect and can help you decide what needs doing and what doesn’t.”

Your agent will know what buyers in your area are looking for and what they’re willing to pay for it. By working together, you can avoid spending money on upgrades that won’t pay off. Instead, they’ll fill you in on which changes will make your house more appealing and valuable.

Bottom Line

Selling a house right now requires more than just putting up a For Sale sign. You need to make sure it’s in good condition to attract buyers who are willing to pay today’s high prices.

The way to do that is by making smart improvements that will give you the best return on your investment. Work with a local real estate agent so you know what buyers are looking for and what your house needs before selling.