It’s no surprise that the upcoming Presidential election might have you speculating about what’s ahead. And those unanswered thoughts can quickly spiral, causing fear and uncertainty to swirl through your mind. So, if you’ve been considering buying or selling a home this year, you’re probably curious about what the election might mean for the housing market – and if it’s still a good time to make your move.

Here’s the good news that may surprise you: typically, Presidential elections have only had a small, temporary impact on the housing market. But your questions are definitely worth answering, so you don’t have to pause your plans in the meantime.

Here’s a look at decades of data that shows exactly what’s happened to home sales, prices, and mortgage rates in previous Presidential election cycles, so you can move forward with the facts as you weigh the pros and cons of your homeownership decision.

Home Sales

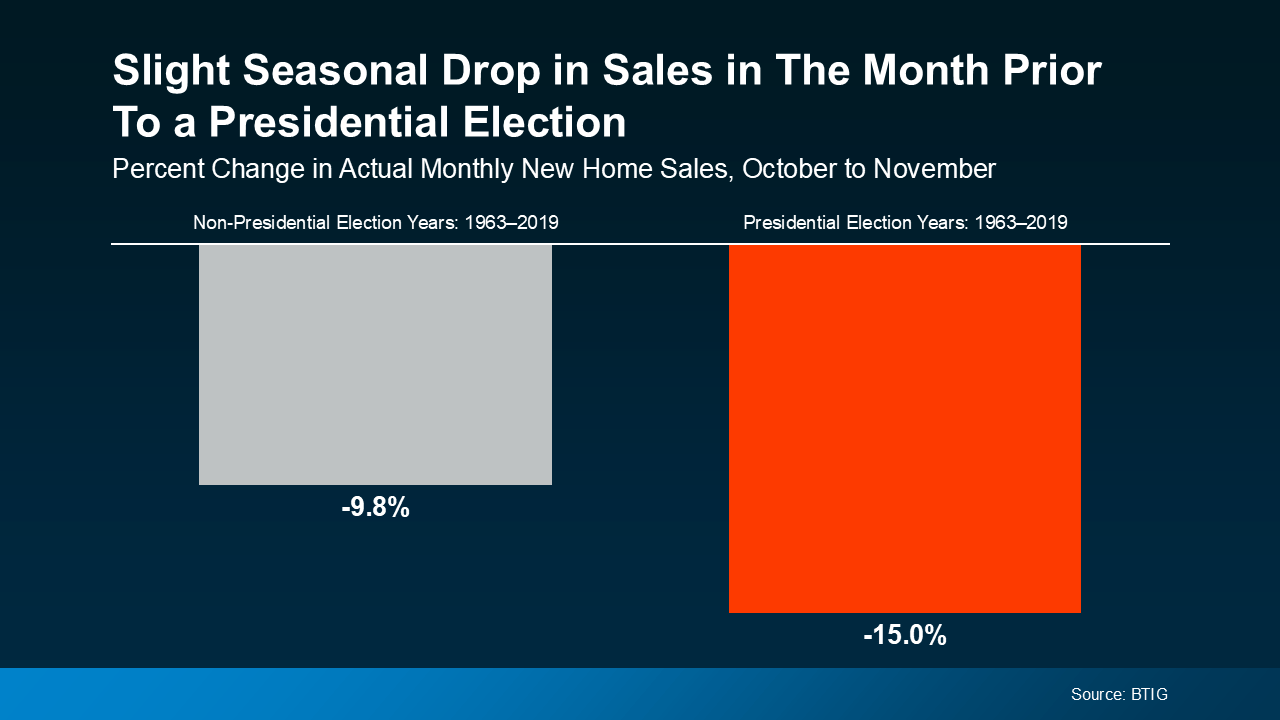

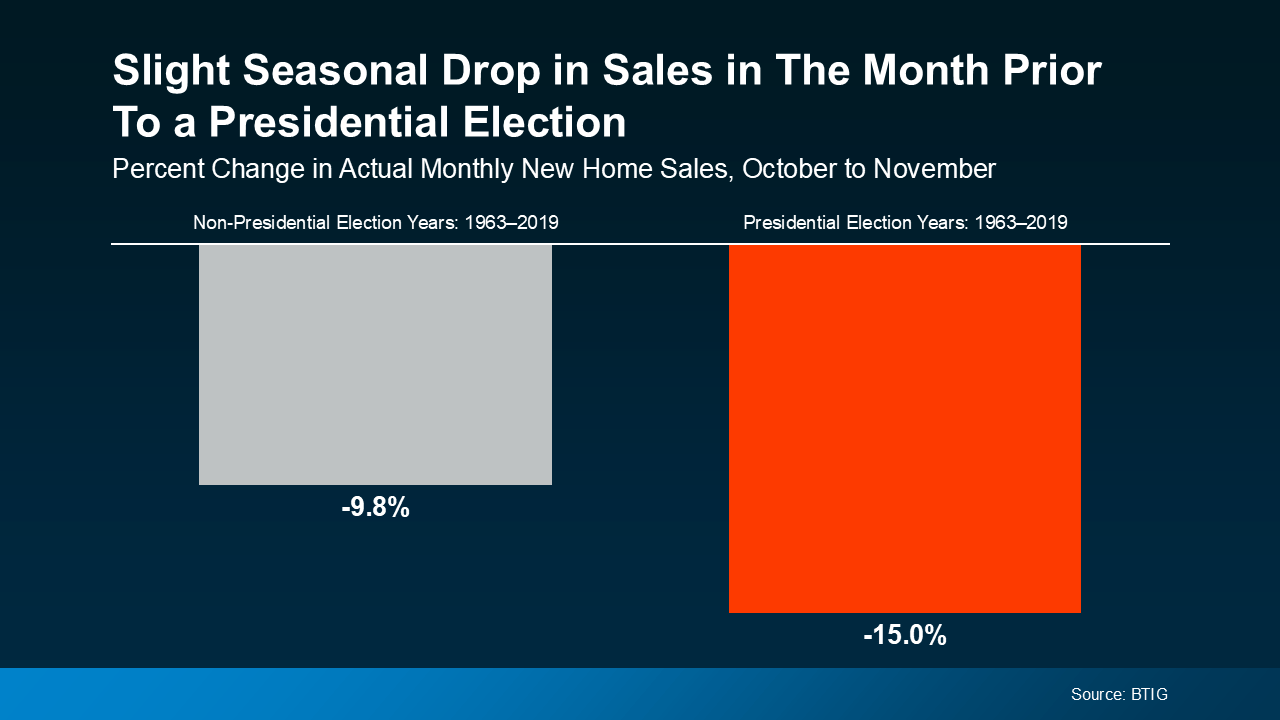

In the month leading up to a Presidential election, from October to November, there’s typically a slight slowdown in home sales (see graph below):

Some consumers will simply wait it out before they make their purchase decision. However, it’s important to know this slowdown is small and temporary.

Some consumers will simply wait it out before they make their purchase decision. However, it’s important to know this slowdown is small and temporary.

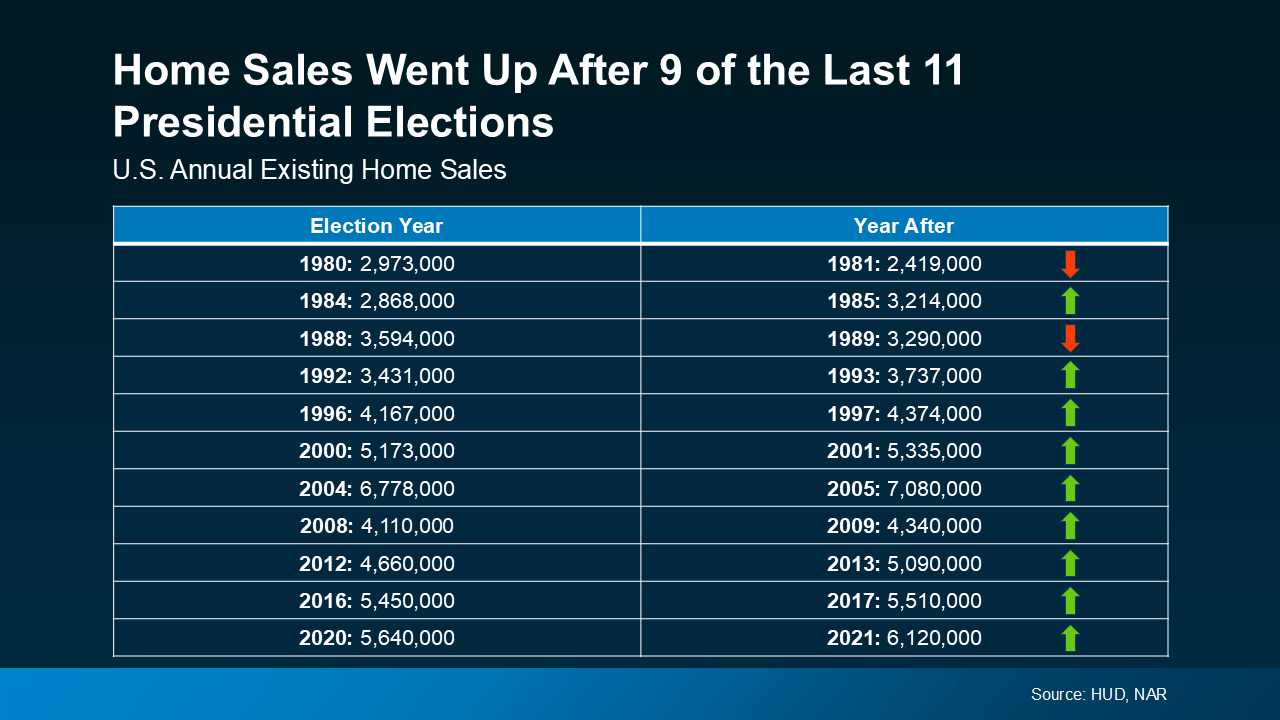

Historically, home sales bounce right back and continue to rise the following year.

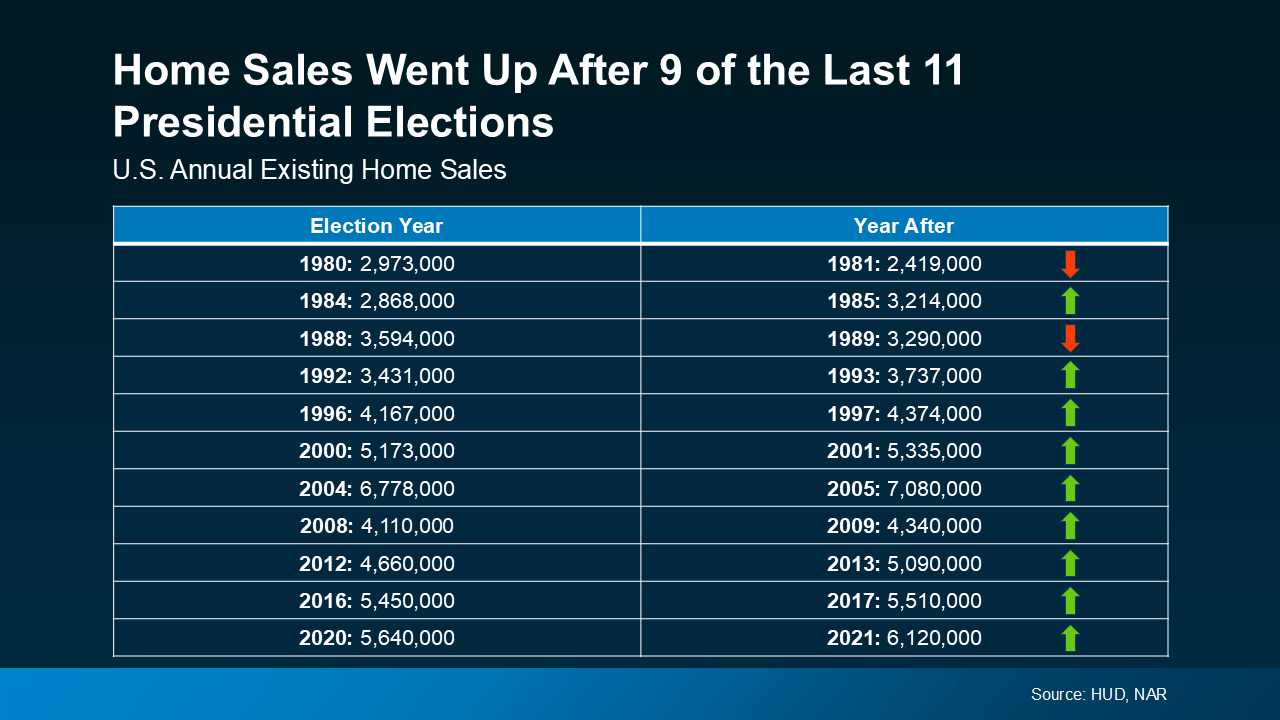

In fact, data from the Department of Housing and Urban Development (HUD) and the National Association of Realtors (NAR) shows after 9 of the last 11 Presidential elections, home sales went up the year after the election, and it’s been happening consistently since the early 1990s (see chart below):

Home Prices

Home Prices

You may also be wondering about home prices. Do prices come down during election years? Not typically. As residential appraiser and housing analyst Ryan Lundquist notes:

“An election year doesn’t alter the price trend that is already happening in the market.”

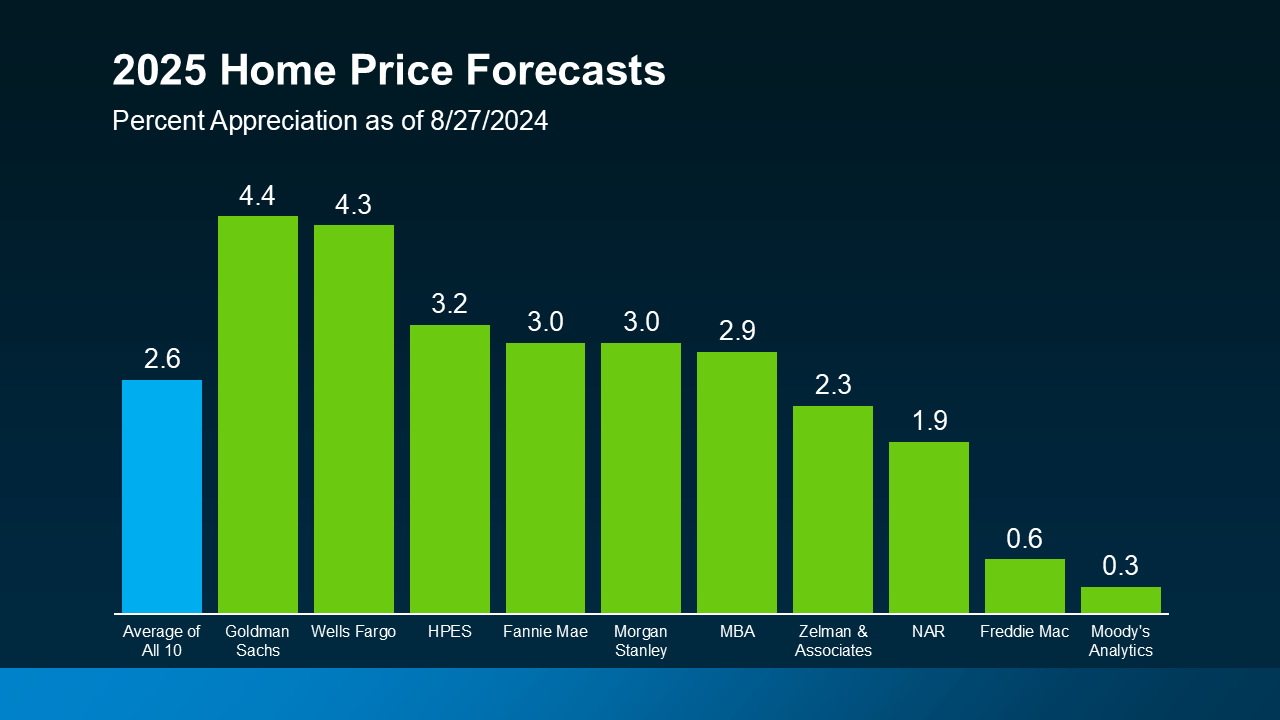

Home prices generally rise over time, regardless of an election cycle. So, based on what history shows, you can expect the current pricing trend in your local market to likely continue, barring any unusual market or economic circumstances.

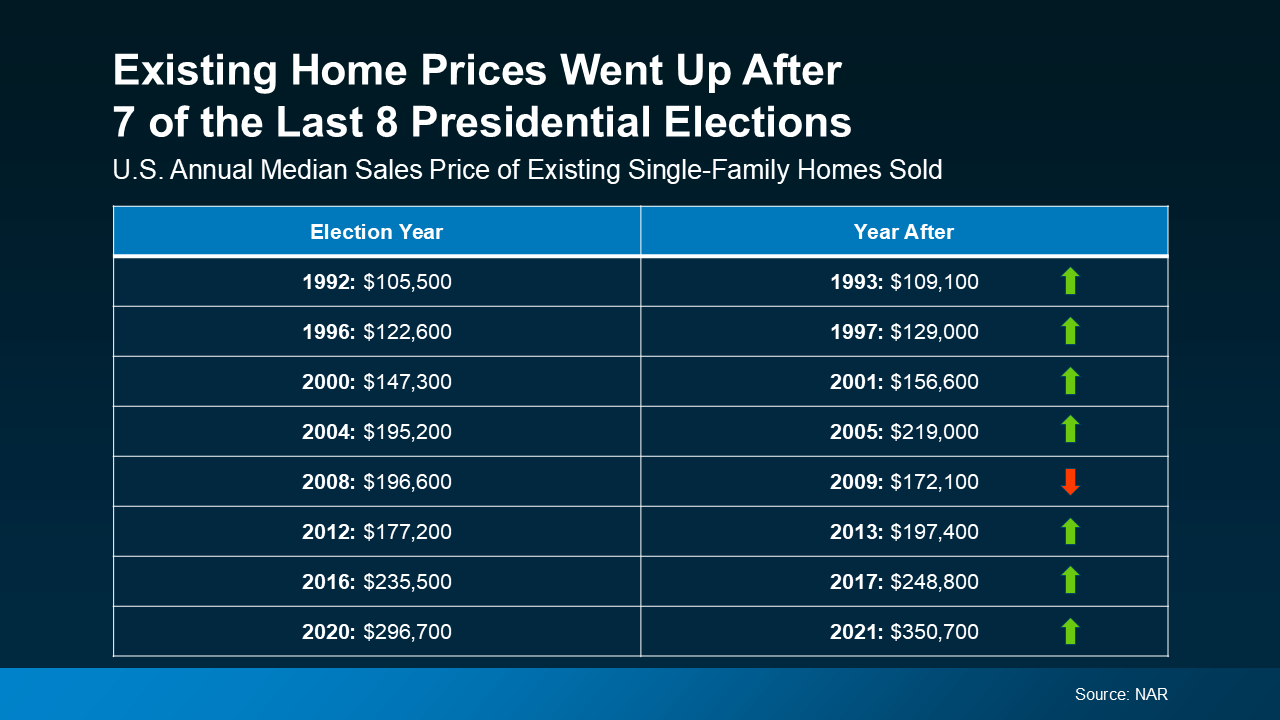

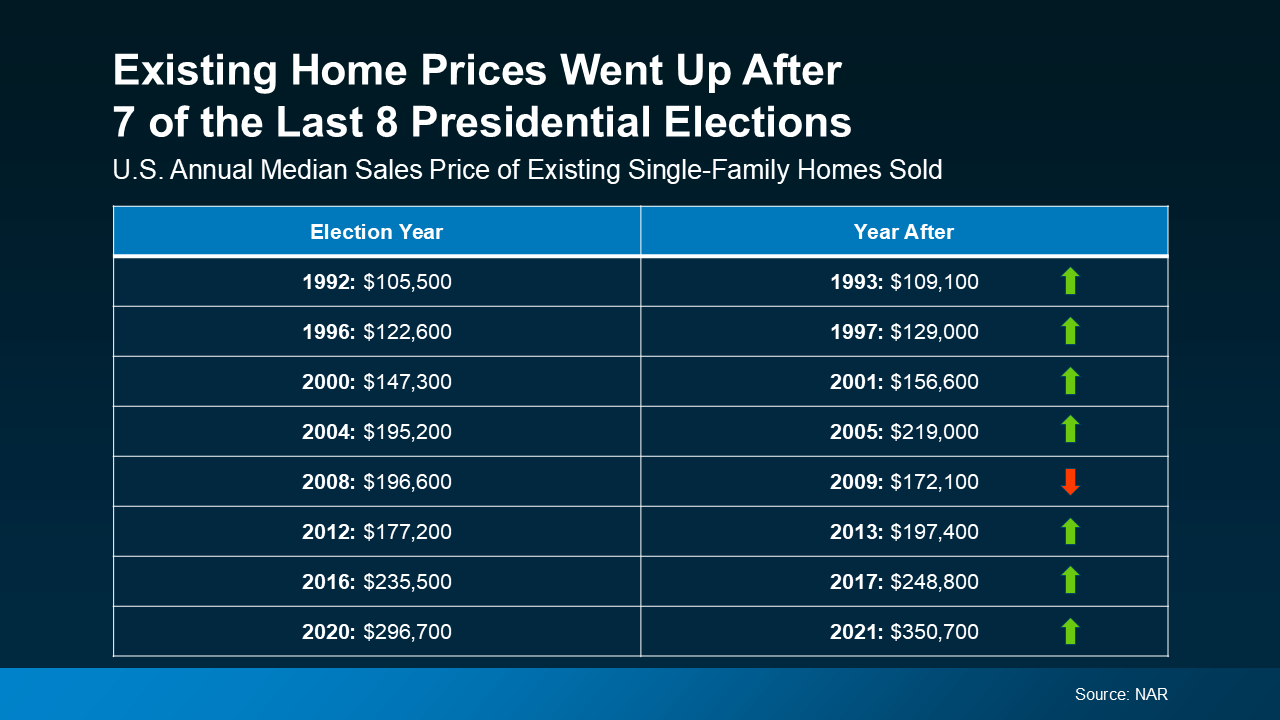

The latest data from NAR reveals that after 7 of the last 8 Presidential elections, home prices increased the following year (see chart below):

The one outlier was from 2008 to 2009, which was during the height of the housing market crash. That was certainly not a typical year. Today’s market, however, is much more resilient. And while prices are moderating nationally, they aren’t on an overall decline.

The one outlier was from 2008 to 2009, which was during the height of the housing market crash. That was certainly not a typical year. Today’s market, however, is much more resilient. And while prices are moderating nationally, they aren’t on an overall decline.

Mortgage Rates

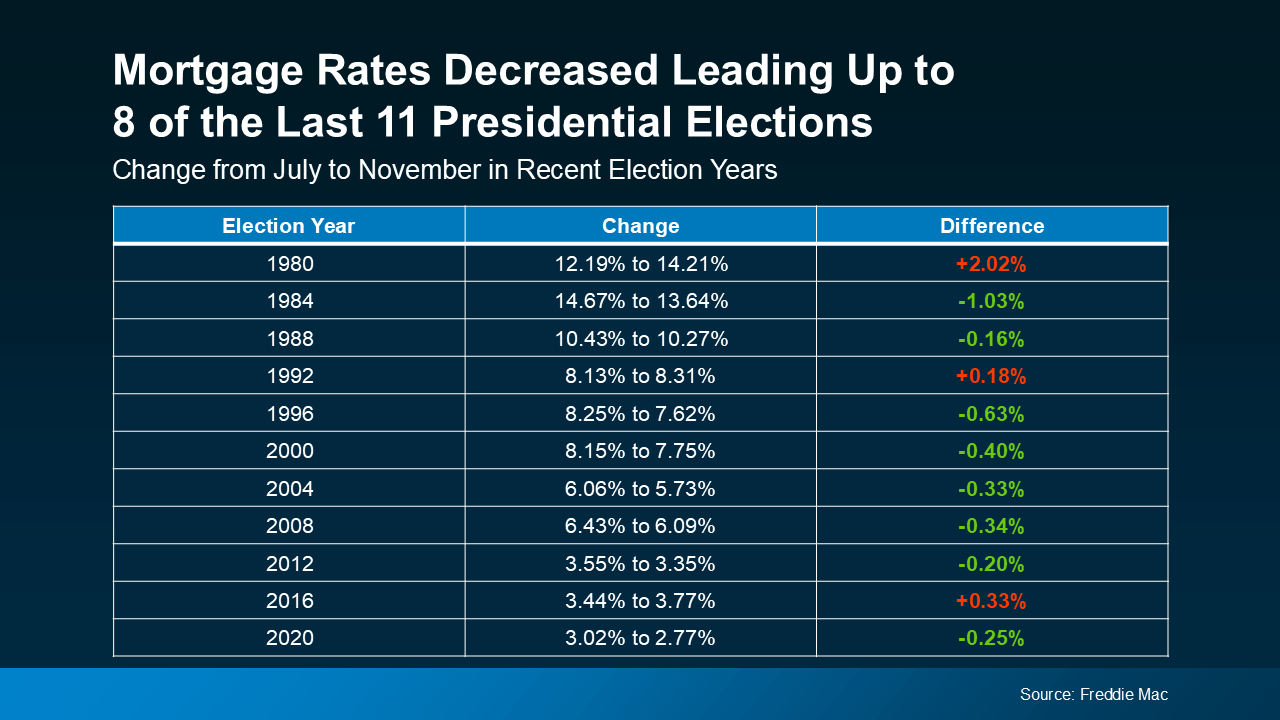

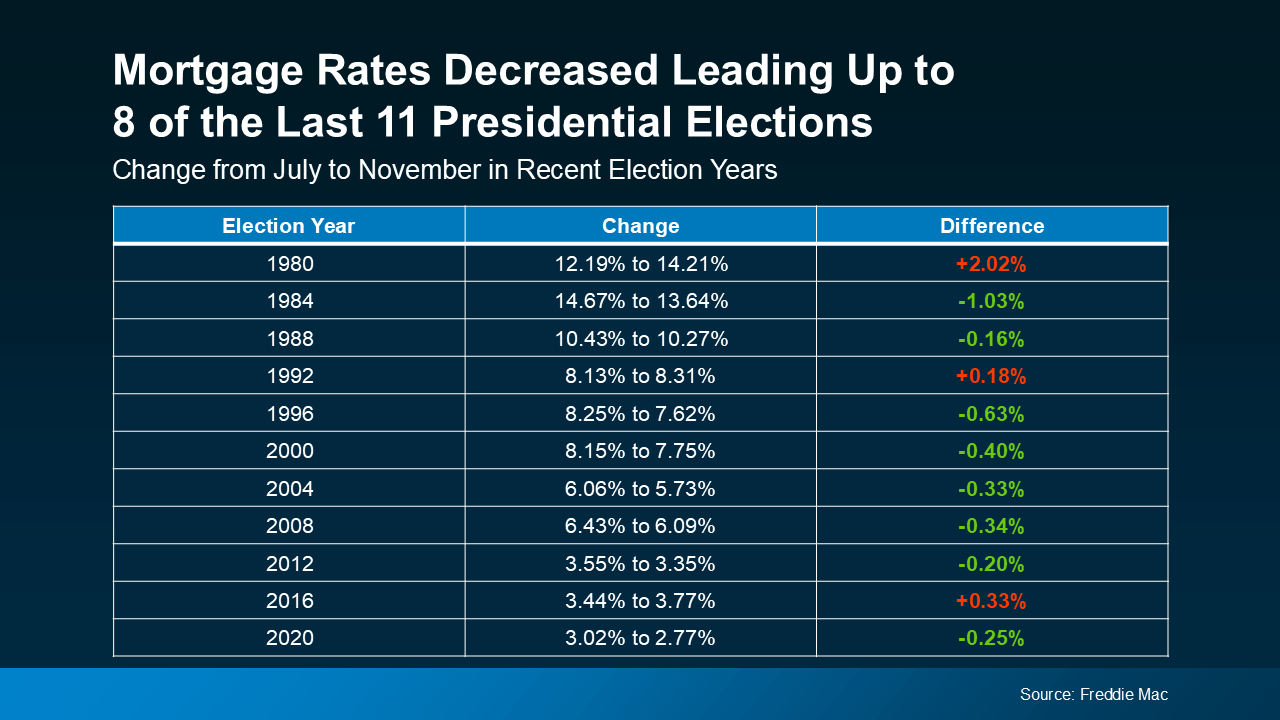

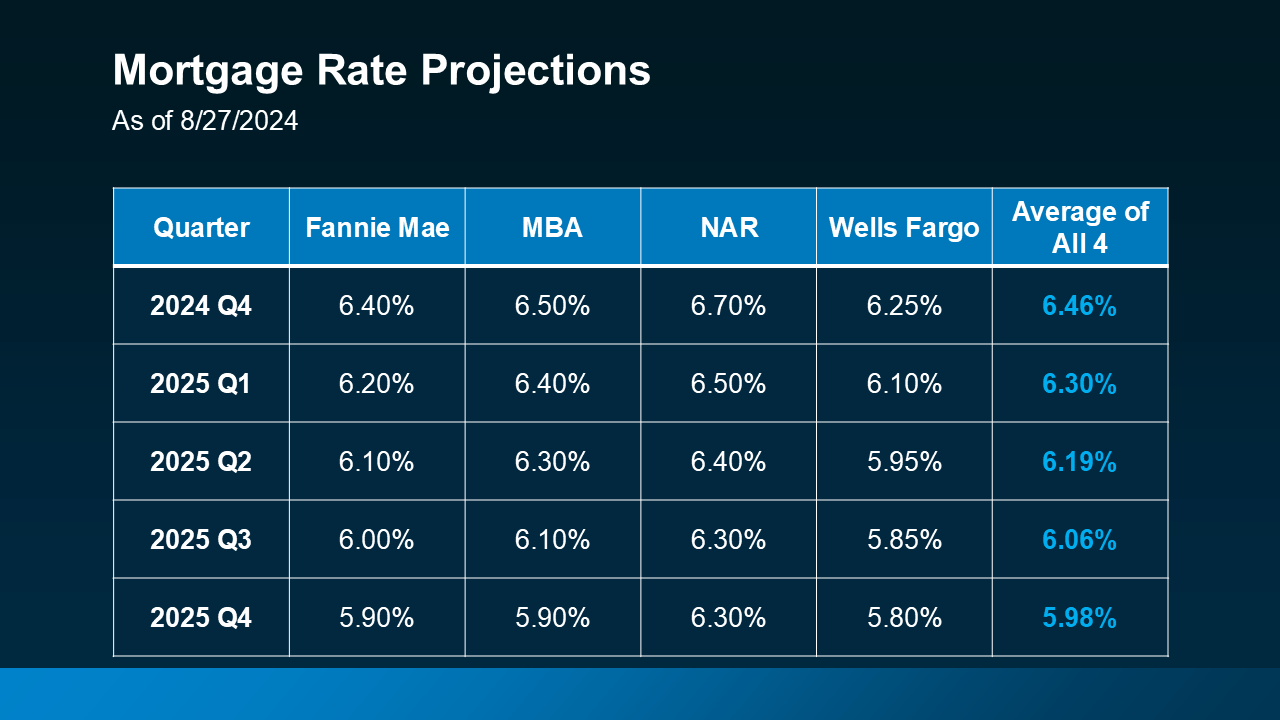

And the third thing that’s likely on your mind is mortgage rates, since they impact your monthly payment if you’re financing a home. Looking at the last 11 Presidential election years, data from Freddie Mac shows mortgage rates decreased from July to November in 8 of them (see chart below):

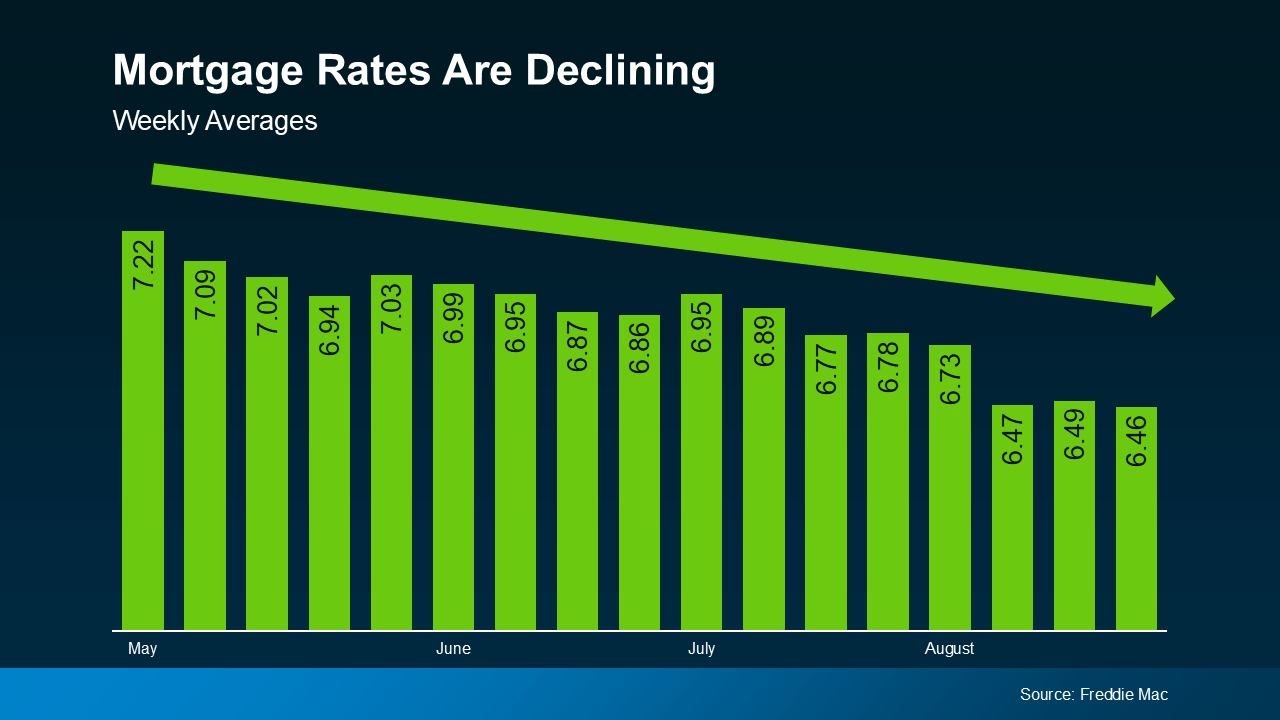

And this year, we’ve already started to see that happen. Most experts also forecast mortgage rates will ease slightly throughout the rest of 2024. If that happens – and all signs right now indicate it should – this year will continue to follow the trend of declining rates. So, if you’re looking to buy a home in the coming months, this could be great news for your purchasing power.

And this year, we’ve already started to see that happen. Most experts also forecast mortgage rates will ease slightly throughout the rest of 2024. If that happens – and all signs right now indicate it should – this year will continue to follow the trend of declining rates. So, if you’re looking to buy a home in the coming months, this could be great news for your purchasing power.

What This Means for You

What’s the big takeaway? While Presidential elections do have some impact on the housing market, the effects are usually minimal. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.”

For most buyers and sellers, elections don’t have a major impact on their plans.

Bottom Line

While it’s natural to feel a bit uncertain during an election year, history shows the housing market remains strong and resilient. And this means you don’t have to pause your plans in the meantime. For help navigating the market during this election cycle, reach out to a local real estate agent.

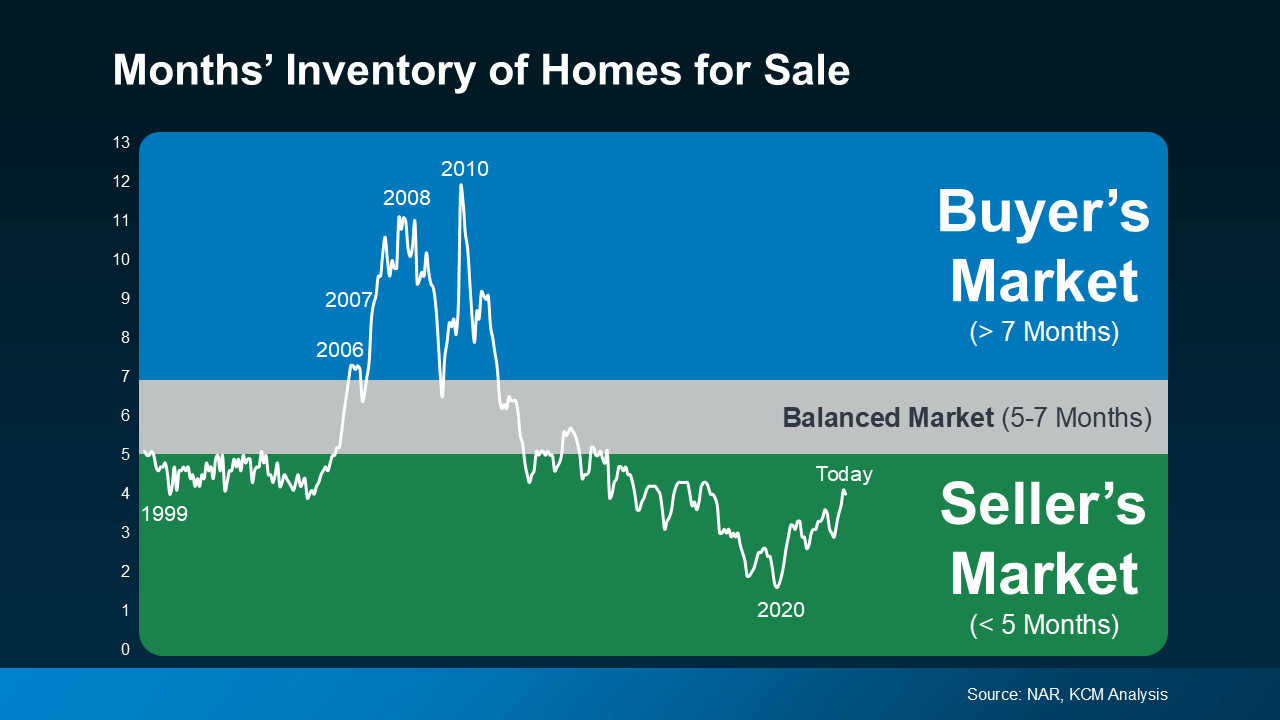

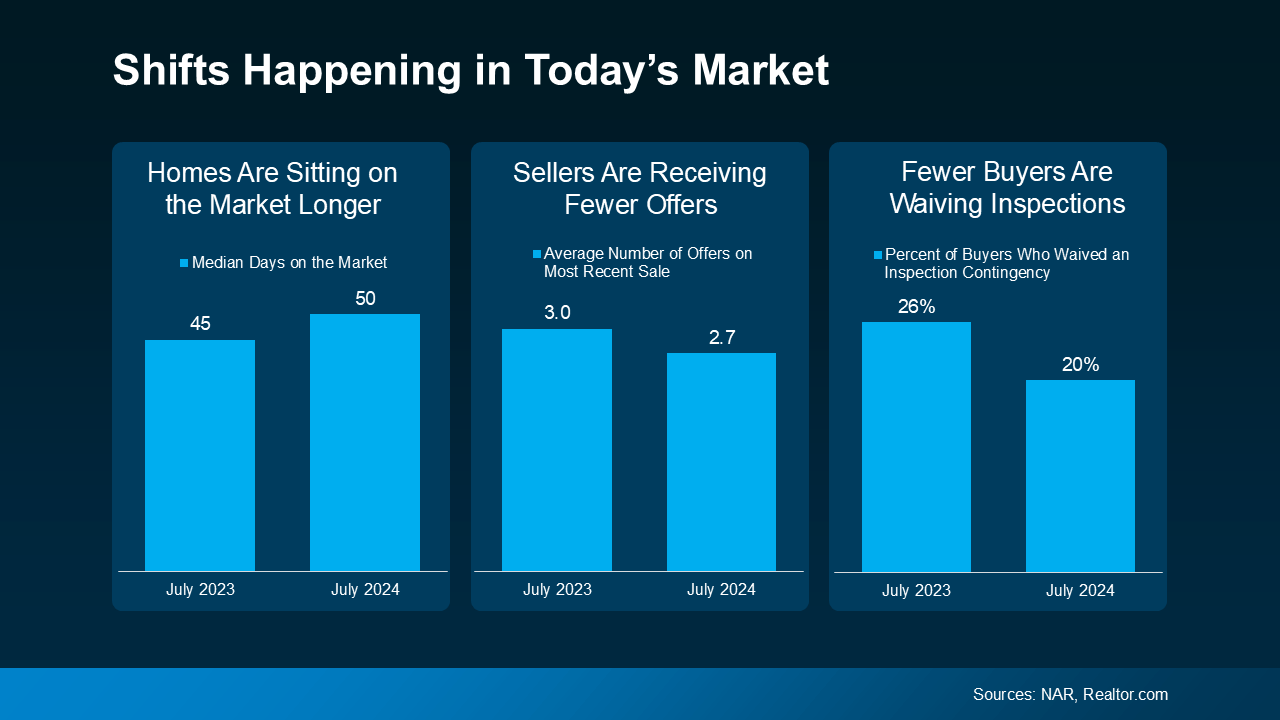

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Some consumers will simply wait it out before they make their purchase decision.

Some consumers will simply wait it out before they make their purchase decision. Home Prices

Home Prices