Some Highlights

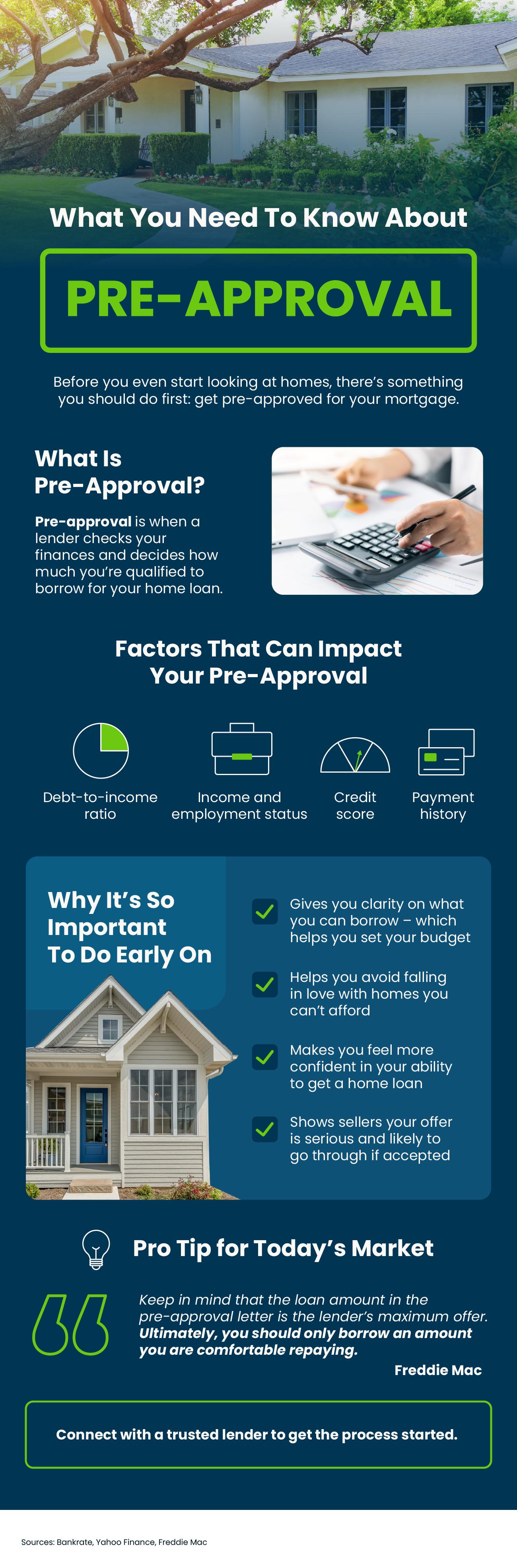

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.